Campaign design team

Why We Should End Duplicated Medical Coverage in Car Insurance: Building a Smarter, Nonprofit System for All

By Vincent Cordova · August 16, 2025

One of the most glaring inefficiencies in our current insurance system is that Americans are forced to pay for the same type of coverage multiple times through different channels. We often don’t even realize it because the system is intentionally complex, but when you step back, the waste becomes obvious.

Today, if you’re involved in a car accident, your medical bills could be paid by your health insurance, by your car insurance (through personal injury protection or “PIP” coverage), by worker’s compensation if the accident happened on the job, and in some cases even by homeowner’s or liability coverage. Each of these industries builds “accident risk” into their premiums, which means the same American family is paying three or four times over for the exact same medical coverage. That duplication drives costs higher than necessary and keeps insurers flush with money while households continue to drown in bills.

This system does not make sense, and it never really has. Instead of pooling our resources in one efficient place, we’ve created multiple overlapping industries all charging for their own version of accident protection. The result is a bloated system where costs compound on top of each other. The truth is, medical coverage should not be duplicated at all. Whether you are hurt in a car accident, at work, or in your own kitchen, it is still medical care — and it should be treated as such under one fair and universal system. That is why transitioning to a nonprofit healthcare model that absorbs all accident-related medical costs is the most rational path forward for America.

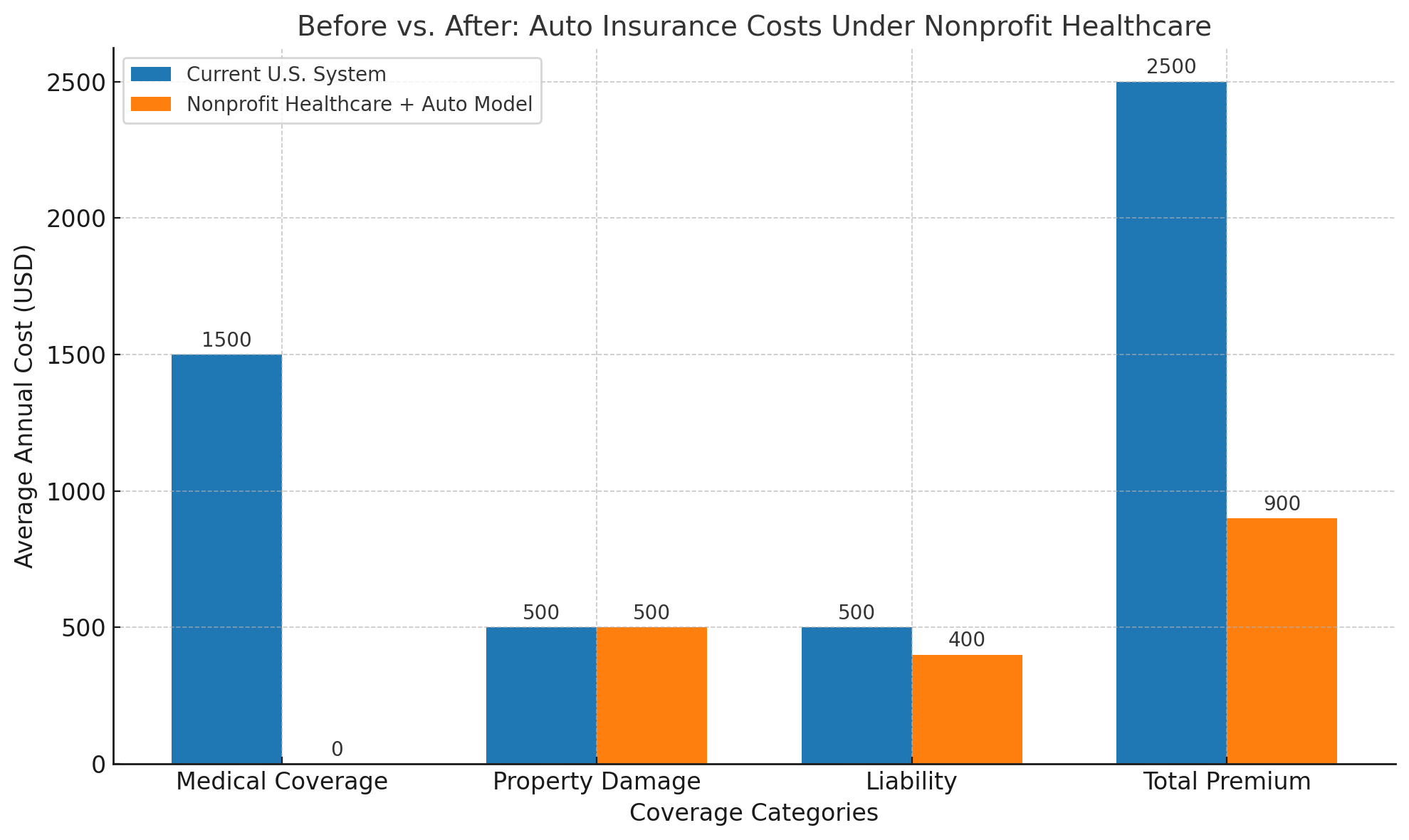

Under a nonprofit healthcare model, medical care from any accident would automatically be covered by the same system that already provides treatment for illness, disease, and emergencies. You wouldn’t need to worry about whether your car insurance includes medical protection, or if your employer’s worker’s compensation is strong enough, or if some loophole will leave you stranded with bills. All of that risk would be removed from the auto insurance industry and consolidated into healthcare, where it belongs. Car insurance would no longer need to cover hospital stays, surgeries, or long-term care after a crash. Instead, it would be streamlined to cover only what it should: property damage, repairs, replacement, and non-medical liability.

Campaign design team

This shift has enormous implications for affordability. Today, auto insurers charge high premiums because medical claims are unpredictable and expensive. A single accident can result in hundreds of thousands of dollars in medical costs, and insurers spread that risk across every driver by raising rates. Once medical coverage is absorbed into nonprofit healthcare, those costs are spread across the entire population in a fair, stable, and predictable way. Auto insurance premiums would drop dramatically because the most expensive category of claims would vanish from their books. This is not speculation — it is exactly how other advanced nations operate. New Zealand has its Accident Compensation Corporation (ACC), which covers all accident-related injuries nationwide. Germany has universal healthcare that automatically absorbs crash injuries. In both cases, auto insurance is cheaper because it only deals with property and liability.

The benefits go beyond affordability. Removing accident medical coverage from auto insurance also reduces lawsuits. Right now, the largest lawsuits after crashes are driven by catastrophic medical bills. Families are forced into court not because they want to fight, but because they are buried under costs that insurance is supposed to cover. With medical expenses already guaranteed under nonprofit healthcare, litigation would shrink. The courts would no longer be clogged with endless personal injury claims, and families could focus on healing instead of battling insurance companies. The ripple effects on our justice system and on the stress levels of everyday Americans would be immense.

Another key advantage is fairness. The current U.S. auto insurance system is notoriously unfair. It uses zip codes, credit scores, gender, and age as pricing factors — meaning two drivers with identical records and identical cars can pay vastly different rates simply because of where they live or how much debt they carry. By shrinking auto insurance down to property and liability only, and placing medical care under nonprofit healthcare, we remove a large share of the bias built into the system. No more worrying that your insurance company will charge you more just because you don’t fit their preferred risk profile. Everyone has the same medical protection, and auto insurance becomes simpler, cheaper, and less discriminatory.

This model also restores trust and transparency. People today are rightly frustrated with opaque insurance billing practices and fine-print exclusions. They are tired of insurers advertising one thing and delivering another. By creating a nonprofit structure where healthcare handles all medical costs, and car insurance covers only what is necessary, the system becomes easier for everyone to understand. You know exactly what your healthcare covers, and you know exactly what your auto policy is for. There are no overlapping responsibilities, no finger-pointing between insurers, and no more confusion about “who pays first.” That clarity is a form of justice in itself.

Critics may argue that removing accident medical coverage from auto insurance is radical, but in reality, it is common sense and aligns with the best practices from other countries. New Zealand, Germany, and Canada’s public insurance provinces have shown us that healthcare and auto insurance can coexist without duplication. In fact, they demonstrate that efficiency, fairness, and affordability increase when systems are simplified. What America needs is not another layer of bureaucracy, but a unifying model that makes sense for the people who pay into it. The nonprofit model offers exactly that. It absorbs all accident-related medical care into healthcare, eliminates unnecessary premiums, lowers overall costs, and ensures everyone is covered regardless of the circumstances.

This is not just about numbers; it is about values. Do we want to keep paying three or four times for the same coverage so that private insurers can profit? Or do we want a system where every dollar goes to care, protection, and recovery? Do we want to accept endless confusion and skyrocketing rates, or do we want simplicity, fairness, and accountability? These are the choices before us. A nonprofit healthcare model combined with nonprofit car insurance is not only possible — it is the logical next step for a country that claims to value efficiency and justice.

The bottom line is simple: it makes no sense to have multiple overlapping medical coverages when one unified system can handle it better, cheaper, and more fairly. By ending duplication and bringing accident care under the umbrella of nonprofit healthcare, we can reduce auto premiums, reduce lawsuits, reduce stress, and increase protection for every American. This is not a dream — it is a proven model that other nations already enjoy. The question is whether we will continue to tolerate waste and profiteering, or whether we will finally build a system that puts people first.