A kids’ arcade or mobile game economy — but scaled up with political branding and foreign investors. - Vincent Cordova

Dynasties, Tokens, and Control: Why America Must Reject Family-Run Financial Systems

By Vincent Cordova

Introduction: The Rise of World Liberty Financial

The launch of World Liberty Financial (WLF) by the Trump family is being marketed as patriotism, financial freedom, and innovation. But when we strip away the slogans, the picture becomes clearer: this is an attempt to build a dynastic financial empire. Not so different in structure from Wall Street giants like Vanguard and BlackRock, but far more dangerous because it is consolidated into a single family with no checks, balances, or accountability.

The Vision Behind WLF

Becoming the Currency Controller

WLF’s “USD1 stablecoin” could evolve into a patriot currency, designed to bypass traditional banks and government oversight. If it gained traction, the Trump family wouldn’t just be token sellers — they’d be the currency gatekeepers of their own financial ecosystem.

Building a Parallel Economy

Token holders may eventually gain access to exclusive services, events, or even influence. This creates a two-tiered system: those inside the WLF ecosystem and those left outside. It’s not about financial freedom — it’s about consolidating loyalty and capital into a family-controlled economy.

Foreign Influence Channels

Early investment has already flowed from Abu Dhabi and Chinese billionaires. This opens the door for foreign adversaries to gain leverage over U.S. politics by simply buying into the Trump family’s private financial system.

We’ve all seen the trick before. You walk into an arcade with a pocket full of dollars, and you walk out with a handful of plastic tokens that only work in their machines. The difference here? Those tokens don’t just buy you a few rounds of Pac-Man — they buy power for a family dynasty.

World Liberty Financial isn’t about financial freedom. It’s the oldest play in the book: turn loyalty into currency, convert real dollars into monopoly money, and pocket the cash while you’re left praying someone else shows up to play. It’s an arcade where the games are rigged, the tokens never cash out, and the house always wins — because the house owns the house.

America doesn’t need digital feudal lords in golden caps pretending to be liberators. We ended monarchies once; we won’t trade our sovereignty for arcade tokens dressed up as patriotism. Real freedom isn’t bought with coins stamped by a family crest — it’s secured by people who refuse to play games with their future.

🎮 The “Arcade Token” Model

- You bring real money (fiat dollars).

- They give you tokens (arcade coins, in-game gems, or in this case, $WLFI / USD1).

- You can only spend them in their world (arcade machines, in-app purchases, or eventually Trump-branded services/events).

- They already have your real cash — whether or not you ever get value back.

🚨 The Difference

With a kids’ game, you know you’re paying for entertainment.

With WLF, they’re selling it as patriotism, financial freedom, and investment, which blurs the line between play money and real sovereignty.

In both cases, the house always wins — but here the stakes are national, not just personal.

⚖️ Why This Is So Dangerous

- It’s gamifying loyalty: “If you love the movement, buy tokens.”

- It’s extractive: real dollars flow into a family-run vault.

- It’s unaccountable: unlike a game company, they also wield political influence and foreign ties.

🔑 Bottom line

It’s like an arcade token system, but dressed up as finance and patriotism. And if enough people buy in, it becomes a shadow currency controlled by one dynasty. Do we really want that? Those days are completely over...

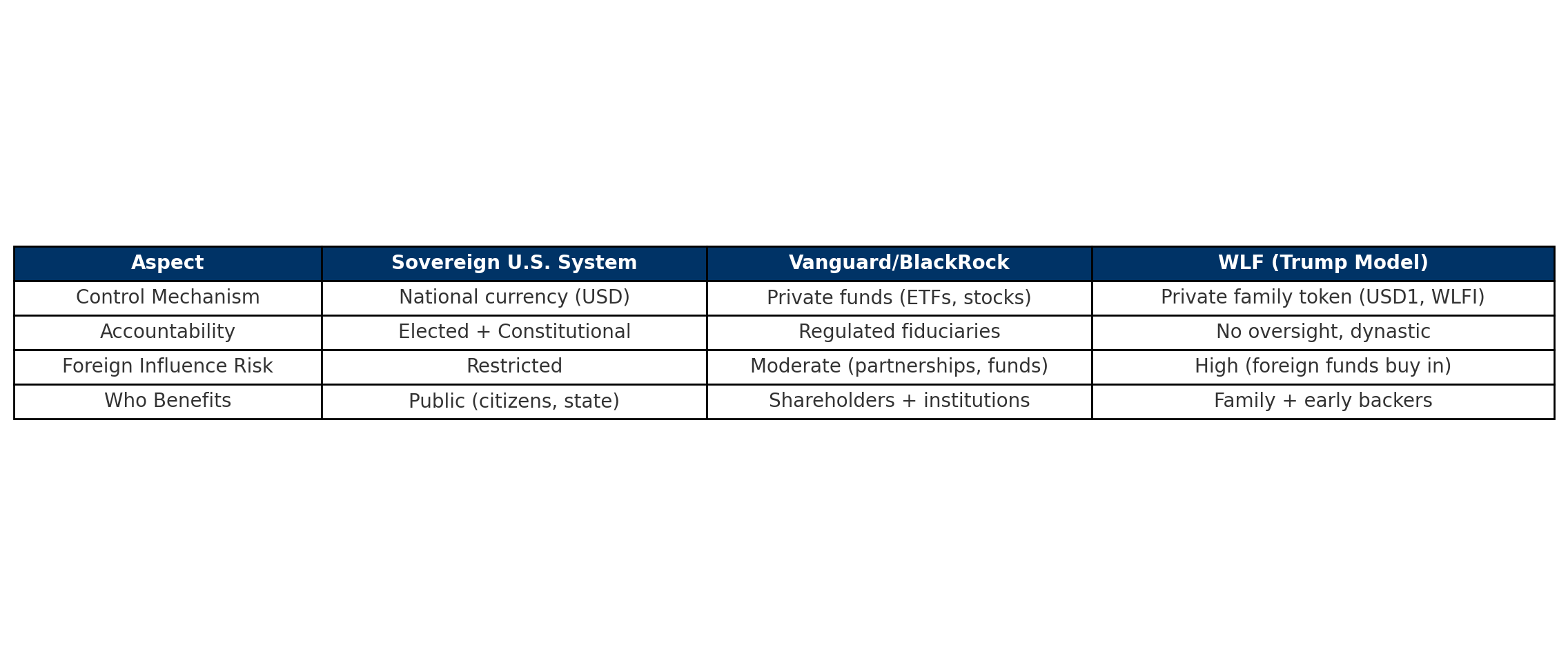

The BlackRock/Vanguard Parallel

To understand the risk, consider the comparison: BlackRock & Vanguard manage trillions, holding shares in nearly every Fortune 500 company. They’re problematic because of centralized influence, but they are at least regulated and bound by fiduciary duties to investors. WLF, in contrast, is unregulated, opaque, and dynastic. There are no investor protections, no fiduciary duties, and no accountability. The Trump family wouldn’t just manage wealth — they’d own the pipes of loyalty-driven capital flow. This isn’t capitalism. It’s closer to neo-feudalism: a return to systems where families and dynasties held control over land, wealth, and power while ordinary people were reduced to dependence.

Image: It visually compares Sovereign U.S. Finance, Vanguard/BlackRock, and the Trump/WLF model.

Why We Must Reject Family Royalty in Finance

We fought revolutions to end monarchy. We rejected dynasties because we recognized a simple truth: power corrupts, and absolute power corrupts absolutely.

Today, instead of crowns and castles, the tools of feudal control are tokens, financial platforms, and private currencies. Allowing a single family to control a currency is not patriotism — it’s regression. It undermines democratic sovereignty and exposes us to capture by foreign interests willing to buy influence through family-controlled platforms.

The Alternative Vision: Finance for the People

Rather than handing financial sovereignty to a dynasty, America should:

- Strengthen public banking and nonprofit financial models.

- Regulate political tokens as campaign contributions.

- Ban foreign ownership of family-run financial assets tied to U.S. politics.

- Protect citizens from debt slavery disguised as patriotism.

Our financial future should be transparent, accountable, and people-first — not a playground for political families or foreign sovereign funds.

Conclusion: A Call to Awareness

World Liberty Financial may look like just another crypto project. But in reality, it is an attempt to repackage dynastic power into a financial instrument. If left unchecked, it risks creating a new form of monarchy in America — not with crowns and thrones, but with tokens and digital ledgers. We must remember: we are all human, no one greater than another. Power belongs to the people, not to families, not to dynasties, and certainly not to unelected private empires.

⚖️ Message to Readers

This is the moment to recognize the threat and stop it before it normalizes. We ended monarchy once. We can end it again — this time in its digital disguise.

⚖️ Bottom line

Fiat dollars are converted into family-controlled tokens. You give up sovereign currency, they pocket it, and you’re left holding a speculative “loyalty badge” that only has value if others keep buying.

💰 Self-Dealing and Price Games

Because World Liberty Financial (WLF) is family-controlled and not publicly regulated, there’s nothing stopping insiders from:

- Buying their own tokens to artificially pump the price (“wash trading”).

- Dumping tokens later when outsiders pile in, leaving supporters holding the bag.

- Staging demand by coordinating purchases through shell companies or foreign partners.

In traditional finance, this would fall under market manipulation and be illegal. In the world of tokens, where oversight is weak, it’s far easier to disguise.

🏰 Why This is Dangerous

If the family uses their own money to bid up the token, it creates the illusion of demand — encouraging loyalists and small investors to buy in. Once the price looks “healthy,” they can cash out their initial stake while keeping the fiat dollars. That turns the token into a loyalty trap: the family profits no matter what, while outsiders gamble on a manipulated market.

⚖️ The Bottom Line

Who’s to say they wouldn’t? No one — that’s the problem. When a single dynasty controls the supply, the rules, and the marketing narrative, they can play both sides of the board. It’s not a free market — it’s a family arcade with a hidden backroom full of rigged machines.

“No crowns, no masters, no tokens of loyalty. We are free people, not serfs.” - Vincent Cordova